- #Singapore salary slip code

- #Singapore salary slip download

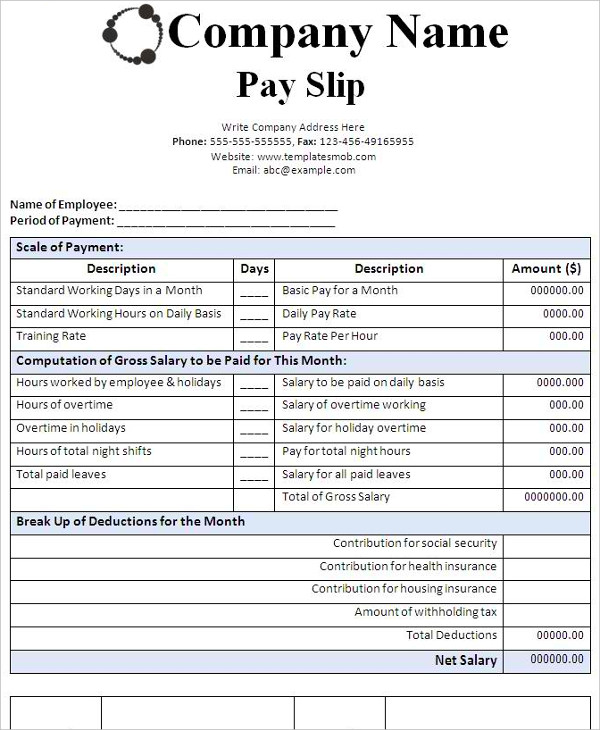

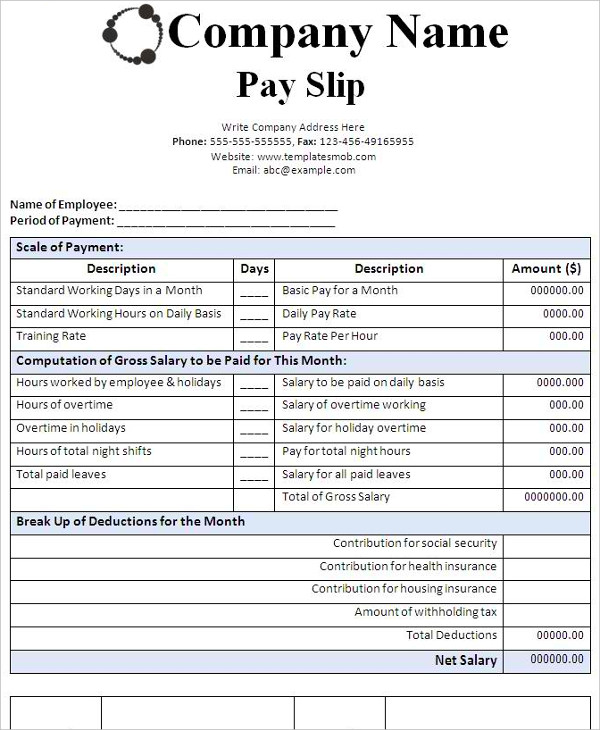

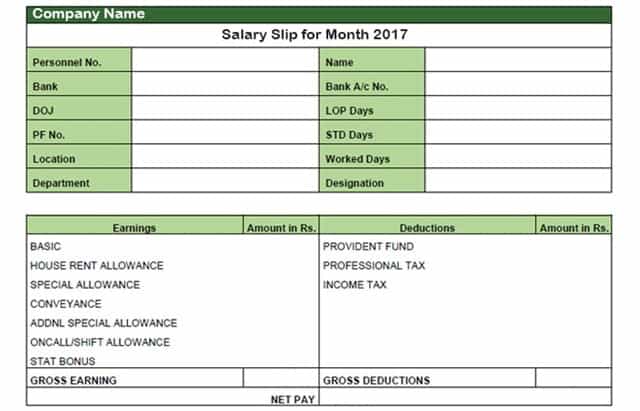

Here is preview of Salary Voucher Template From ,

#Singapore salary slip download

Here is download link for this Salary Voucher Template,

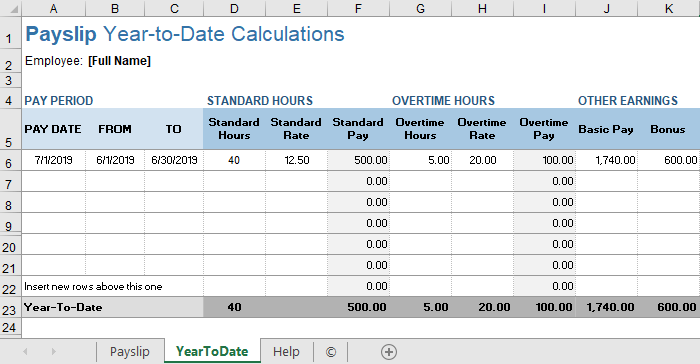

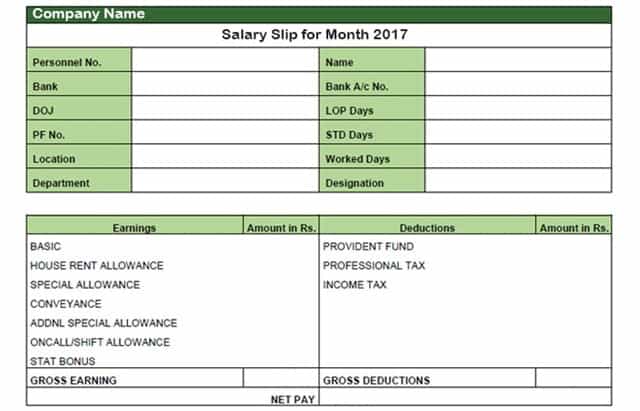

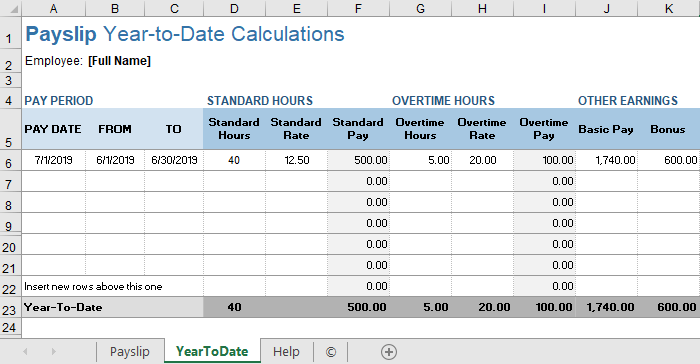

In this way, a salary slip voucher id designed as a trend & information can be added as well by you. The total amount of the earnings & deductions is written down at the bottom of the column.In another column put the deductions as well.Model of the payment (cash, check, or bank deposit).Prepared by the employer & then an employee signs the slip, on receiving the salary.It must be specially designed having all information about the company like company name, logo, address, official phone number, fax number etc. A formal sheet of paper on which details has to be written.The salary voucher is an evidence to prove that I have been pay & this can be shown to the other employees who just attended the job & in case of any dispute, this salary voucher can be presented in the form of proof.Ī format is designed of the salary slip voucher, having the following features Salary slip or voucher is of great concern & this helps in identifying the upcoming problem to save from them. Put the blank for the signatures of the employer giving pay to another employee in order to ensure that payment has been given as well as received by the person.Put the signatures of an employee and if possible ask employee to sign in the record book after receiving the salary so that record book can check in case of any misunderstanding or fraud.The date of issuing salary to the employee should mention on salary slip for record.Write down the month in which payment has to be given, because it is most important thing for proper check & balance and to avoid any fraud.Current designation of an employee in the firm, it can either be printed on salary slip or hand written.

#Singapore salary slip code

Name of the employee on the top of the salary slip, the specific code if authorized to the employee can be mentioned. The salary slip must have following information regarding an employee Overtimes can also be awarded by the salary slips. This salary slip is awarded to the employee as an honor of pay, or tax can be deducted as this, or there might be some taxes, or can be national insurance contributions made by the person or as pensions. When the salaries are given to the employee from an employee, then a document is prepared, this document is designed or formatted to give all the information regarding the salary details a person gained in regard to the hard work. When something is developed as a change, then it is called as a trend. The salary slip voucher is designed as a trend & this is an employment contract. The trend is actually anything that is adopted as a fame or popularity as well. The salary is given after a specific period, not before the time & not after the time that is it cannot be late and is given by an employee to the employee, working in the same area as well, and giving services to the company.įor a salary, to put on the salary slip, need to be designed as a trend. This salary can be given in the form a salary slip, monthly or annually. While having a very high standard of living, Singapore is also ranked first worldwide for the ease of doing business.The salary is given to the employee as a reward of hard work & working hours. The annual Population in Brief report shows that foreigners represent 40% of the population in Singapore, as of June 2018. Tourism is one of the biggest contributors to the Singaporean economy, attracting over 17 million international tourists annually, more than 3 times Singapore's total population. The current highest personal income tax rate is at 22%. Individuals are taxed only on the income earned in Singapore and the tax rates for resident taxpayers are progressive, with higher rates being applied to higher income levels. The personal income tax rate in Singapore is one of the lowest in the world and depends on the residency status. The economy of Singapore has been ranked as one of the most open and competitive economies in the world, making it a business-friendly regulatory environment for local entrepreneurs.

The average monthly net salary in Singapore (SG) is around 6 005 SGD, with a minimum income of 2 500 SGD per month.

0 kommentar(er)

0 kommentar(er)